A Comprehensive Survey

of Bay Area Real Estate Markets

73,000 Bay Area home sales worth $76 billion

were reported to MLS over the past 12 months

June 2018

————————————————————

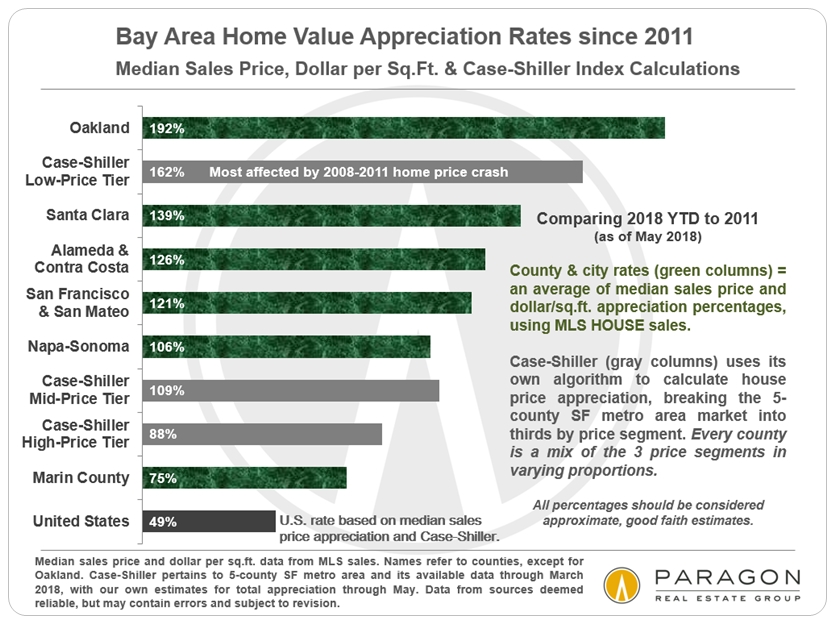

Bay Area Home Value Appreciation Rates

since 2011 (the post-crash bottom of the market)

The county and city appreciation percentages in the chart above were calculated by averaging changes in both median sales prices and average dollar per square foot values. We also incorporated S&P Case-Shiller SF metro area calculations based upon its algorithm breaking the market into thirds by price segment. Each city and county includes within itself a wide variety of individual real estate markets of different price segments and varying dynamics, so these percentages are broad generalities. It is impossible to know how they apply to any particular home without a specific comparative market analysis.

IMPORTANT NOTE: As with stock market (or bitcoin) performance, comparative appreciation rates in housing markets vary wildly depending on the exact start and end dates of the analysis.

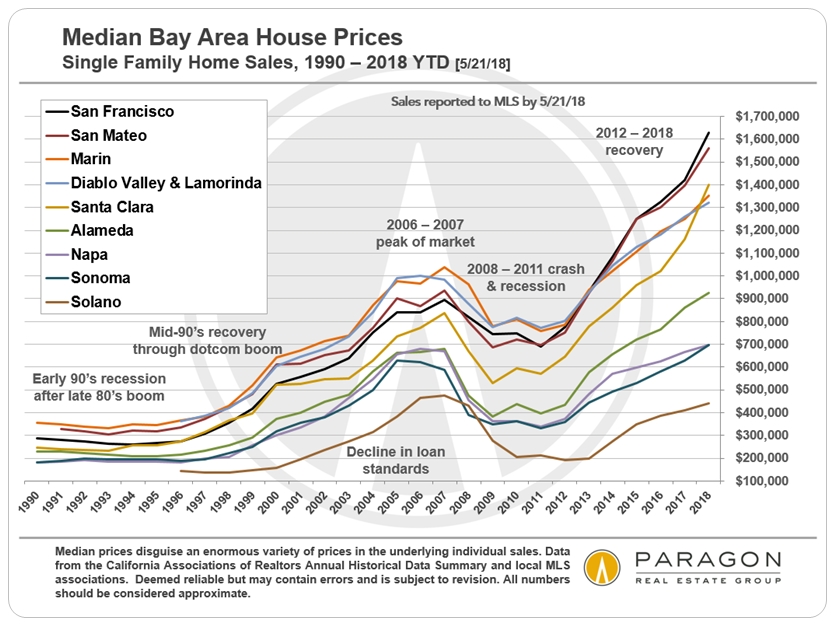

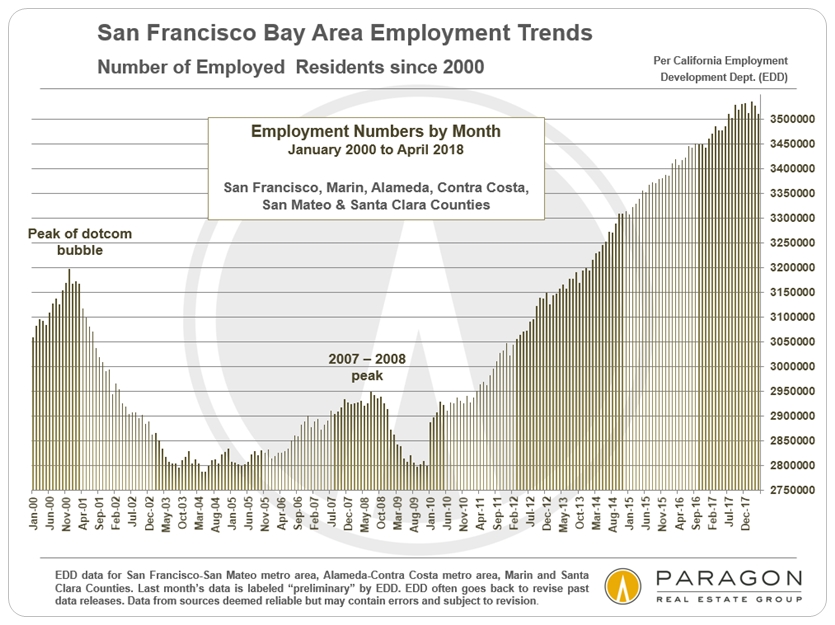

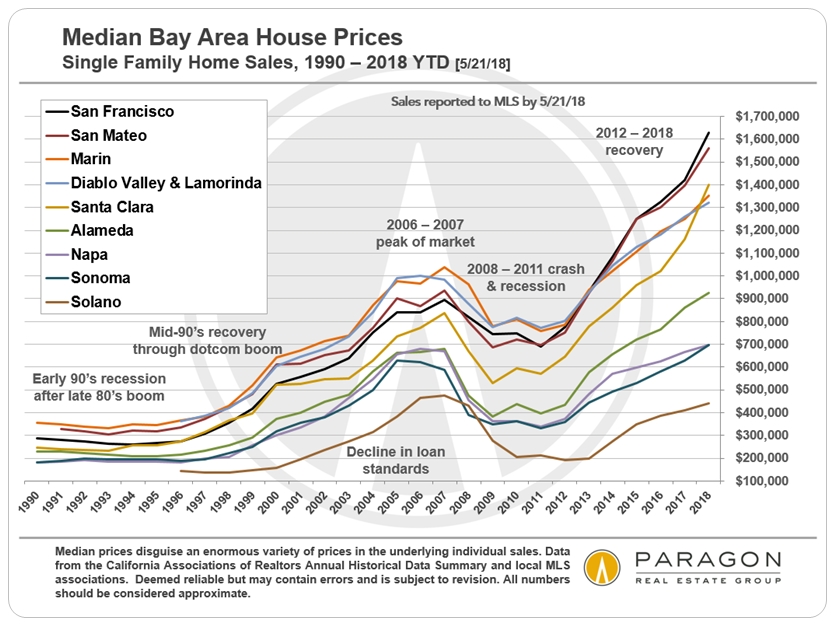

Bay Area Median Home Price Trends

since 1990

Major Factors in Bay Area Appreciation

The appreciation rate and market dynamics of each individual Bay Area market since 2011 has each been affected by a mix of different factors – to greater or lesser degrees:

1) Being at the center of the high-tech boom (San Francisco, San Mateo, Santa Clara); 2) proximity to the central counties, but with significantly lower housing costs (Alameda County and especially Oakland are prime examples): 3) being affected to an outsized degree by subprime financing and the 2008-2011 distressed-property price crash (Oakland and many outlying, less expensive areas); 4) relative affordability: in recent years, as home prices soared, the highest pressure of buyer demand moved to less costly markets within and between counties; 5) substantially increased supply due to new construction (SF condo market); 6) increases in the average size of homes sold (+13% in SF); and 6) the general national economic recovery: U.S. home prices have appreciated by about 49% since hitting bottom in 2011.

This chart illustrates the dynamics of the enormous appreciation rate in Oakland since 2011, following its drastic crash in prices during the market recession: Chart: Oakland median price changes. And this chart based on Case-Shiller data illuminates the vast differences in the magnitude of bubbles, crashes and recoveries of different home price tiers: Chart: Appreciation Trends by Price Segment.

Generally speaking, the most affluent neighborhoods, with the most expensive homes, have appreciated less on a percentage basis (but more on a dollar-increase basis) than more affordable neighborhoods – especially over the past 2-3 years. This dynamic also occurred in the latter period of the last housing boom.

There were sometimes specific local factors, such as the terrible fires in Sonoma, or the opening of the new Apple spaceship headquarters, which played roles in boosting home prices in their locales.

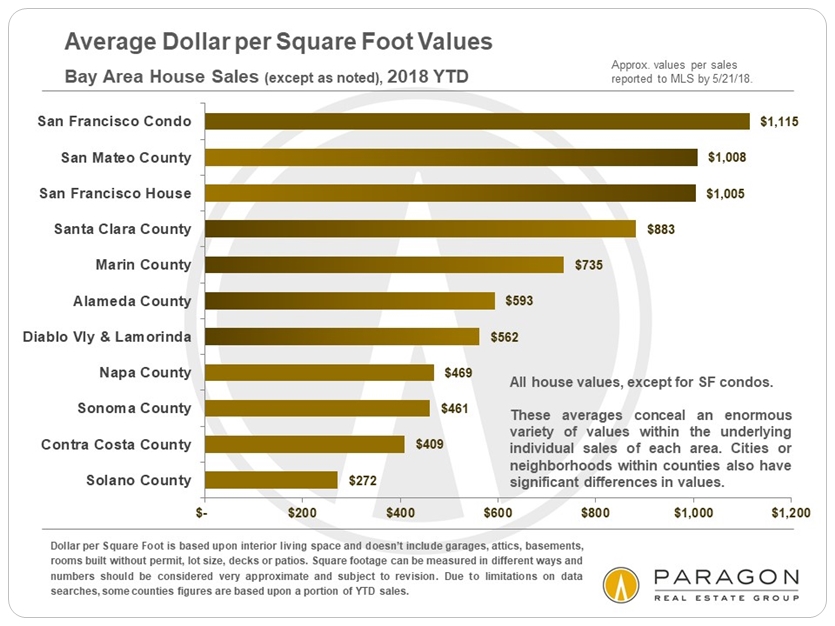

Bay Area Average Price per Square Foot Values

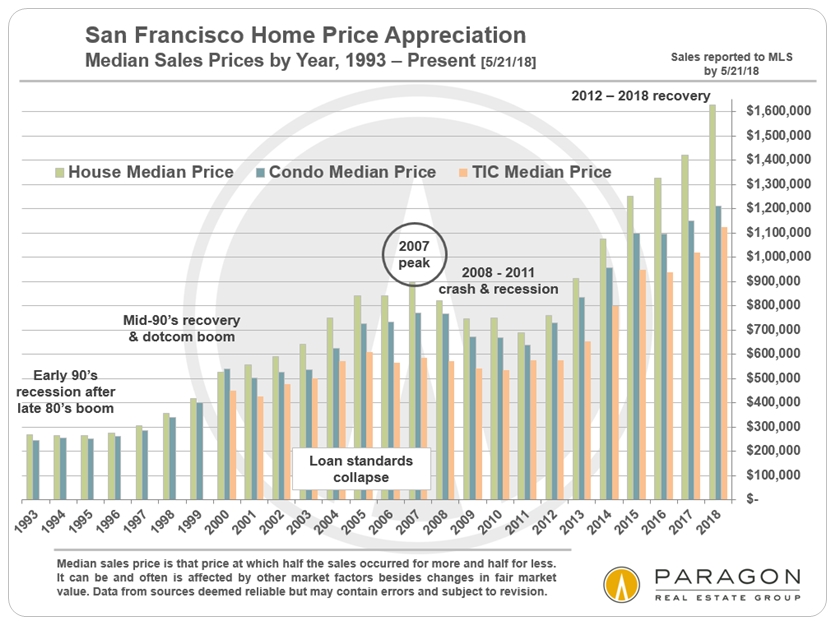

San Francisco County Median Price Trends

since 1993

Within SF, appreciation rates have diverged between houses

and condos due to classic supply and demand factors.

Many more analyses specific to San Francisco County and its neighborhood markets can be found here: San Francisco Market Report

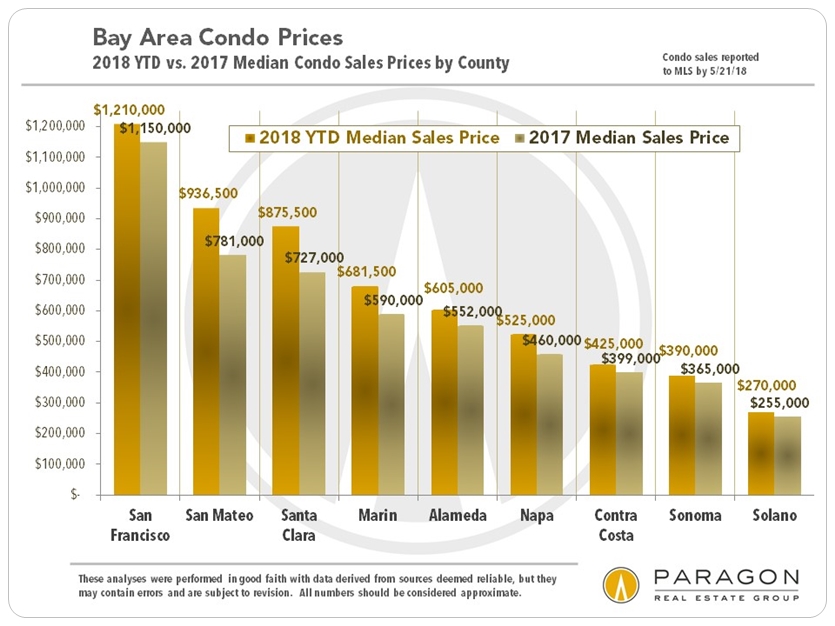

Bay Area Median Condo Prices by County

Year-over-year changes

Condos are the distinctly more affordable home purchase option, though that is less true in San Francisco than in other counties. Indeed, overall in the city, condos sell at higher price per square foot values than houses, but, of course, average condo size is much less.

The high-tech boom has led to a considerable divergence between Bay Area and national home price appreciation rates, as illustrated in this graph based on Case-Shiller data:

Long-Term Home Price Appreciation Trends

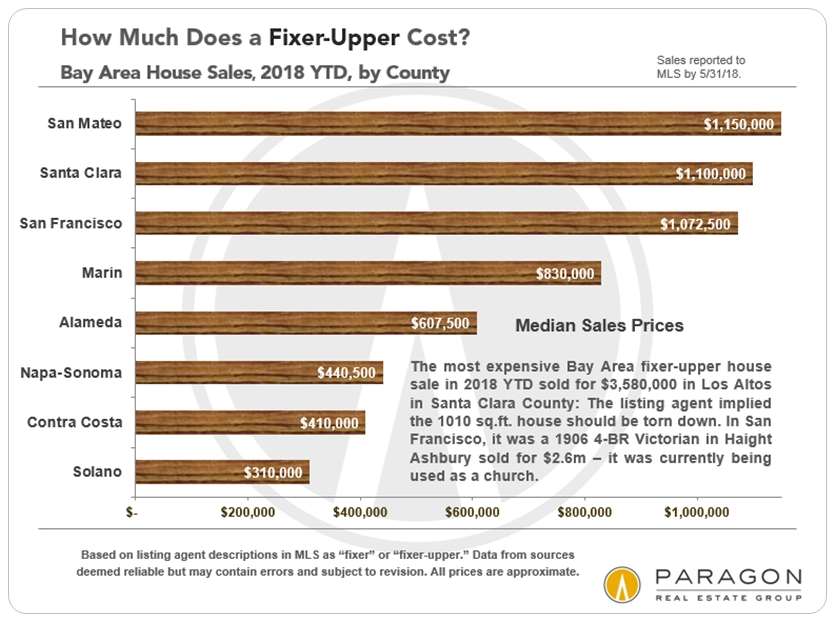

Fixer-Uppers: Median Sales Prices

————————————————————

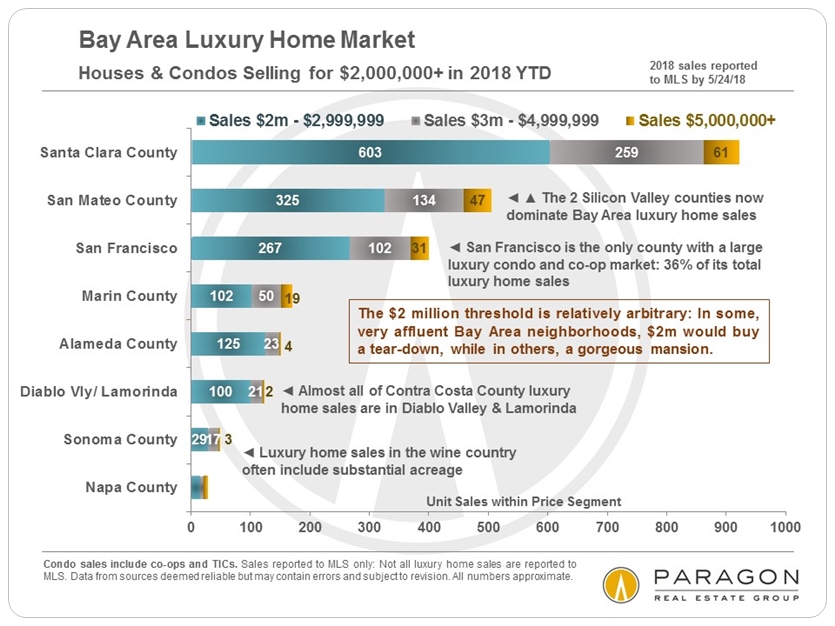

Bay Area Luxury Home Markets

There are very expensive neighborhoods and enclaves throughout the Bay Area, but the fabulous creation new wealth has supercharged Silicon Valley high-end real estate sales above all others.

Bay Area luxury home markets by county.

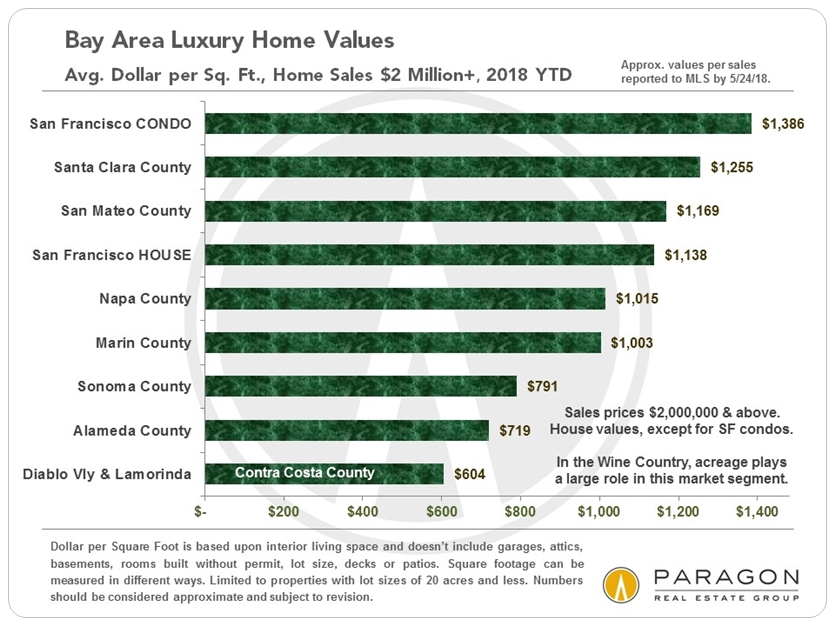

How much luxury home one gets for the money varies considerably between counties. On a dollar per square foot basis, the highest values are found in San Francisco luxury condos, often high-rise units with utterly spectacular views.

————————————————————

Bay Area Real Estate Market Dynamics

Sales by Price Segment

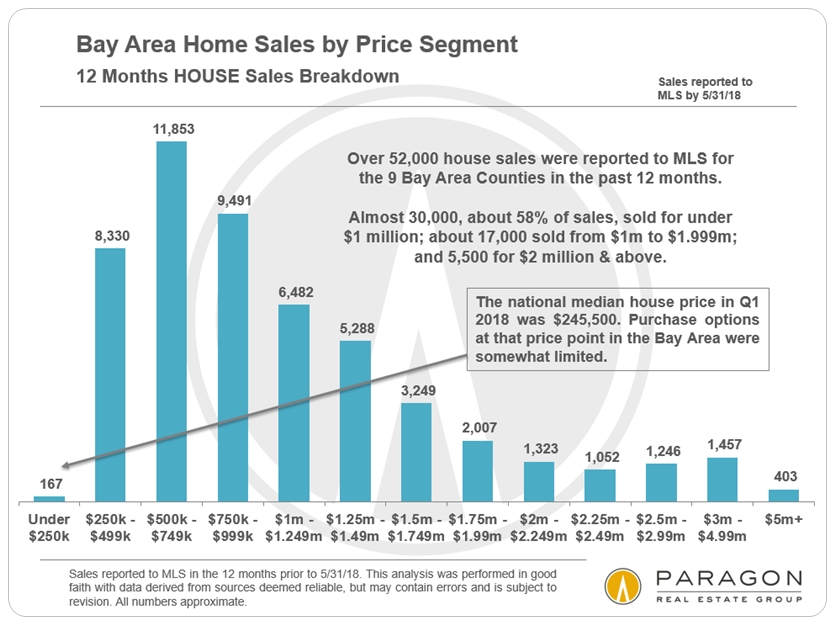

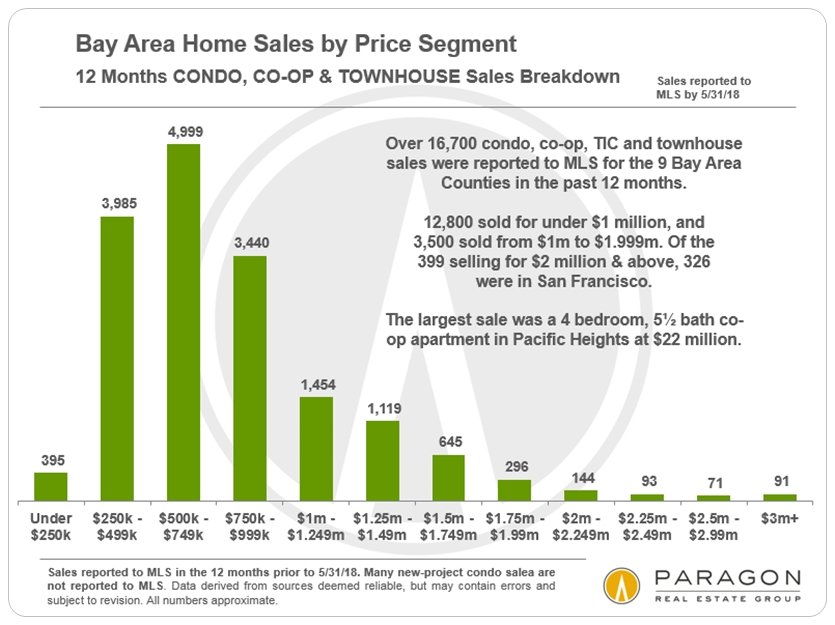

These next 2 charts break out house and condo sales in the 9-county Bay Area by price segment. (We roughly estimate another 10 to 12% of such home sales were not reported to MLS, and not included below.)

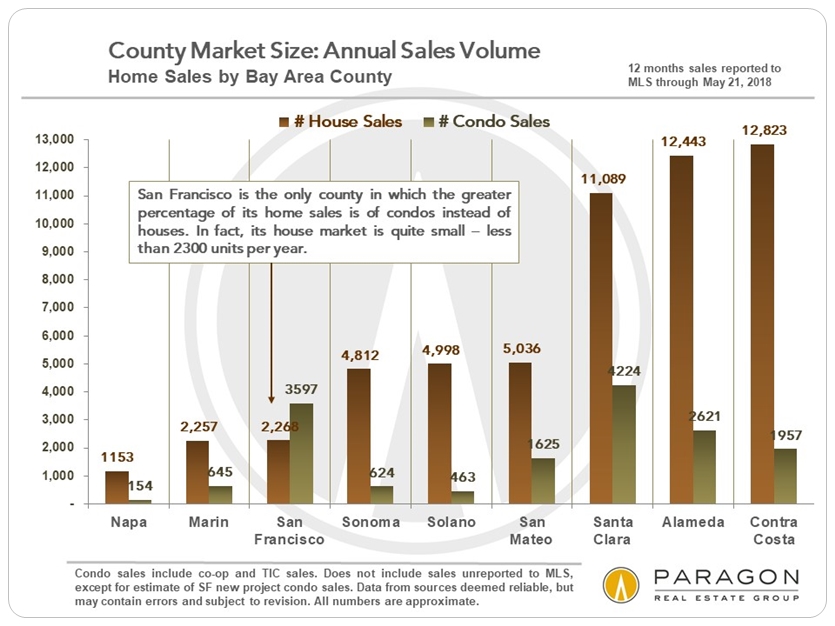

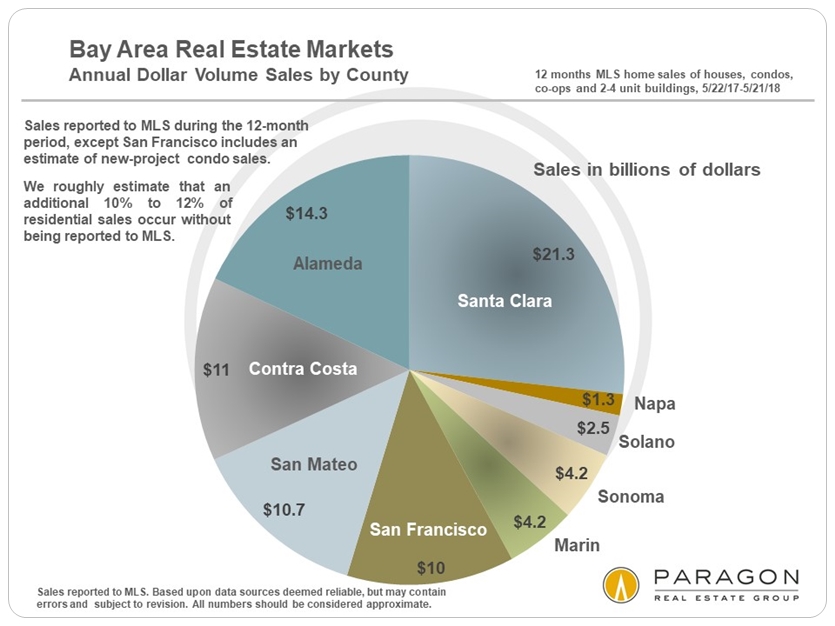

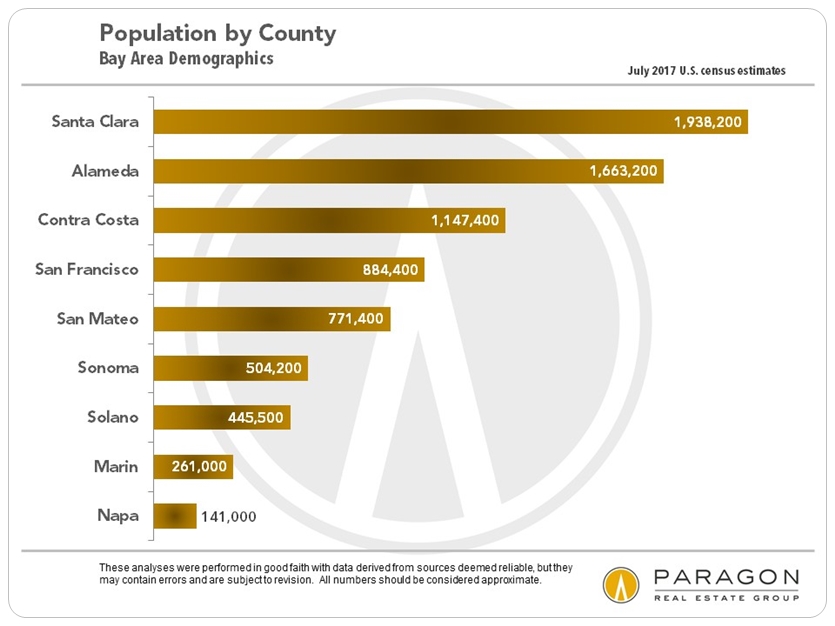

Respective Market Sizes

By unit sales volume, the Bay Area is utterly dominated

by Santa Clara, Alameda & Contra Costa Counties.

San Francisco & San Mateo close the gap in dollar

volume sales due to their high home prices.

The above chart tracks dollar volume sales for houses, duets, condos, co-ops, TICs and 2-4 unit residential buildings. If the sales of larger multi-unit residential buildings and commercial buildings were included, sales volumes would soar for some counties. For example, in San Francisco, 74% of all transfer taxes collected in 2017 related to property sales of $10m+, the vast majority of which were larger apartment buildings and commercial properties.

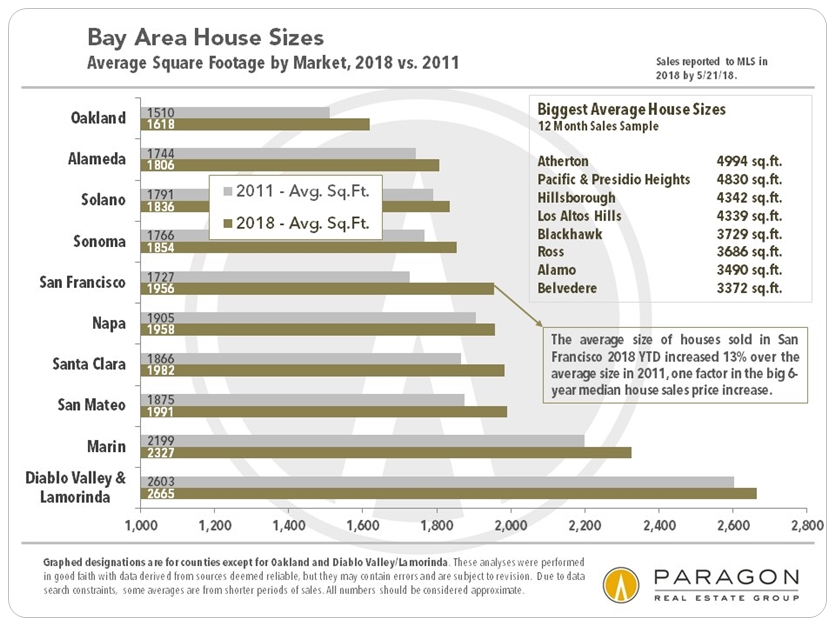

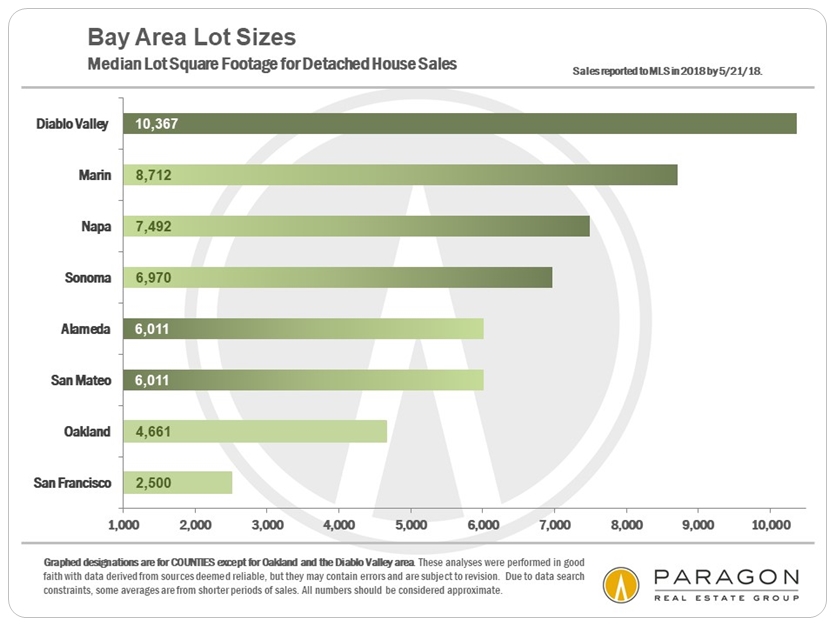

Home and Lot Sizes

As the economy recovered from the recession, people began to buy larger houses, which is one factor in increasing median home sales prices. The average size of houses sold in San Francisco increased 13% over the period, but is still far below those in Marin, and in Diablo Valley & Lamorinda in Central Contra Costa County.

Marin & Diablo Valley also have the largest median lot sizes.

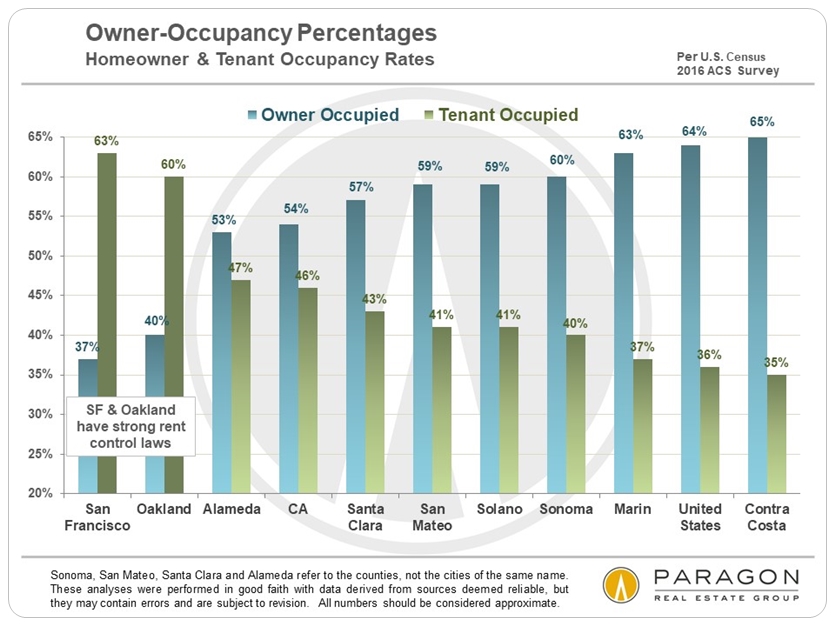

Homeownership & Tenant-Occupancy Percentages

Of the 9 Bay Area counties, only San Francisco has a higher percentage of renters than of homeowners (though certain cities of other counties do as well).

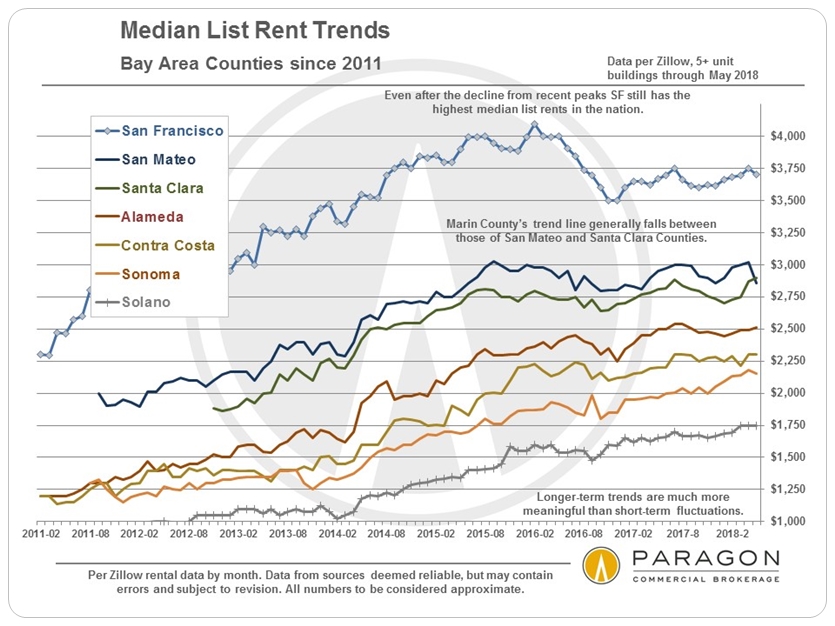

On the issue of rent and eviction controls, people have a tendency to vote their own financial interests (and not according to their opinions on macro-economic housing-supply theory): Tenants for controls, and landlords and homeowners (potential landlords) generally against them. This is why strong rent control measures are typically found only in CA cities with majority tenant populations, such as SF, Oakland, Berkeley and Santa Monica. Upwardly spiraling rents, as illustrated in the below chart, has made this one of the most intense political issues of the day, to be voted on at the ballot in November.

Bay Area Rent Trends

The Bay Area has the highest rents of any metro area in the nation.

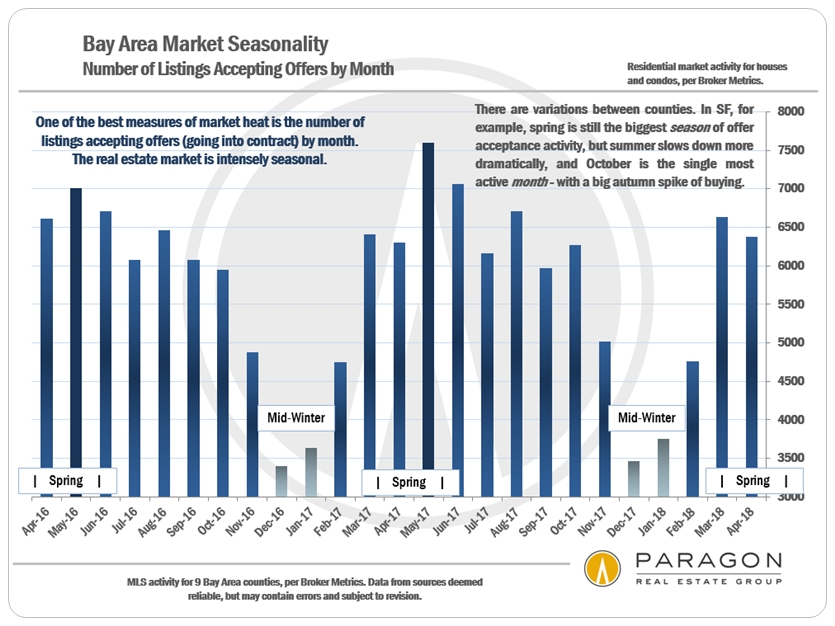

Supply, Demand & Market Seasonality

Most Bay Area markets will now start to transition from the more heated spring sales season to the less active summer season. Part of this dynamic is a marked increase in price reductions. Seasonal trends do vary by county: Sonoma, for example, has a strong second-home market which can peak in mid-summer. San Francisco and Marin typically see dramatic spikes in sales during the short autumn selling season. All markets head into big slowdowns for the mid-winter holidays, before waking up and beginning the cycle again in the new year.

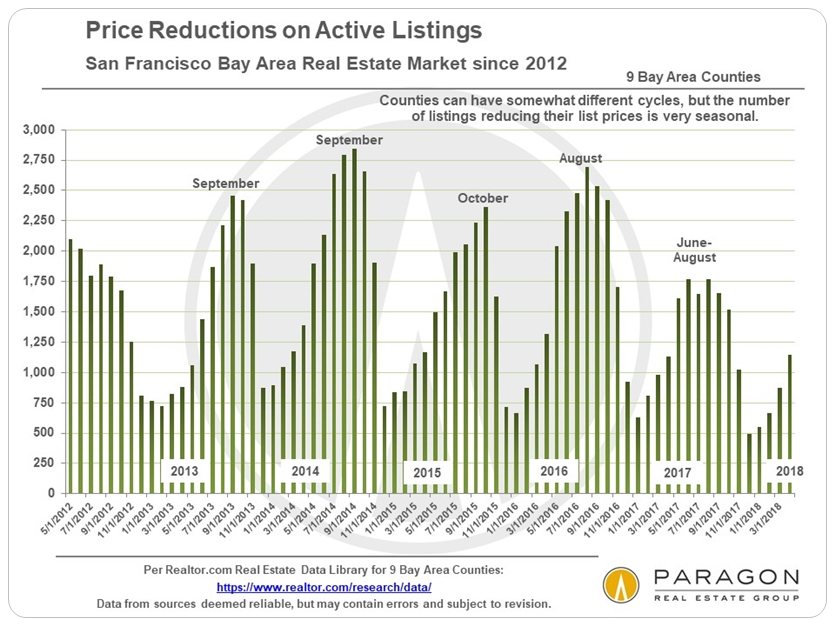

Price Reductions

As the spring market ends, the major period

for listings reducing their asking prices begins.

————————————————————

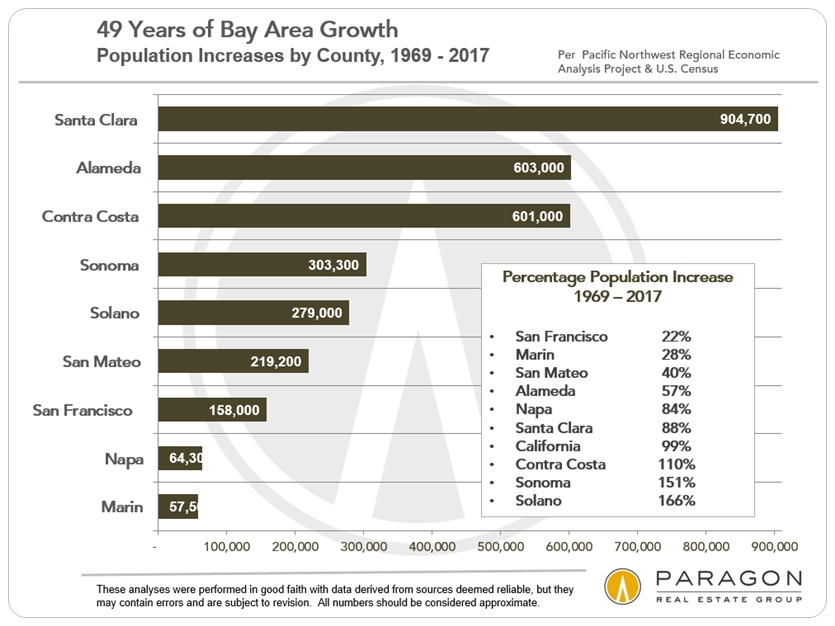

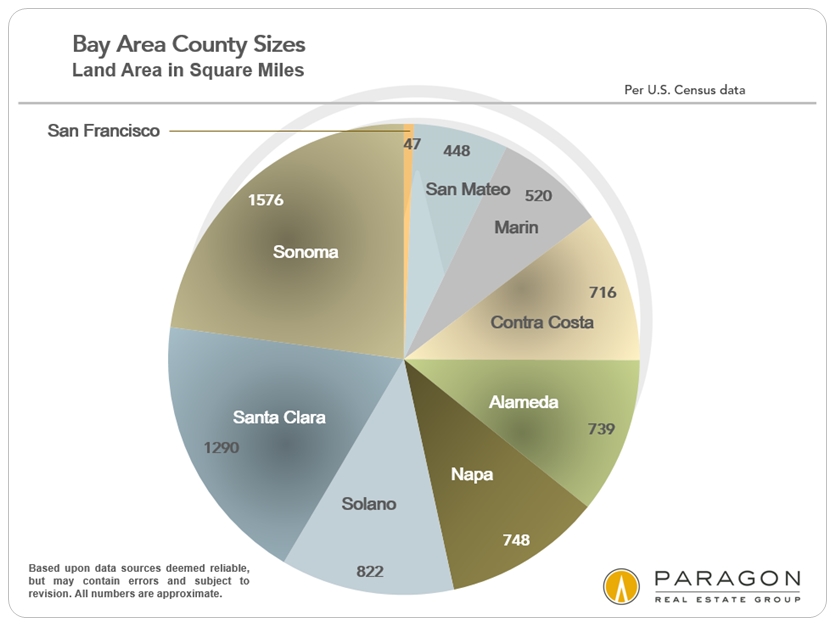

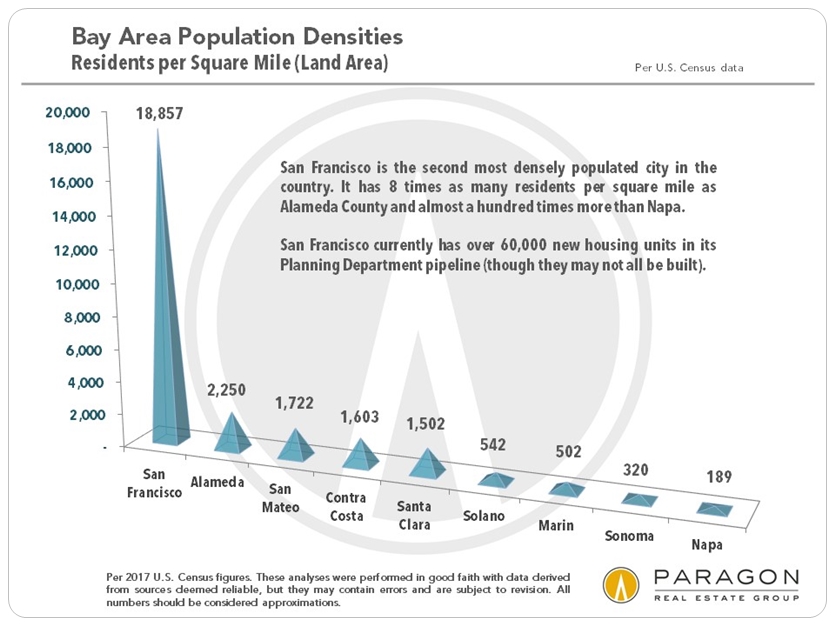

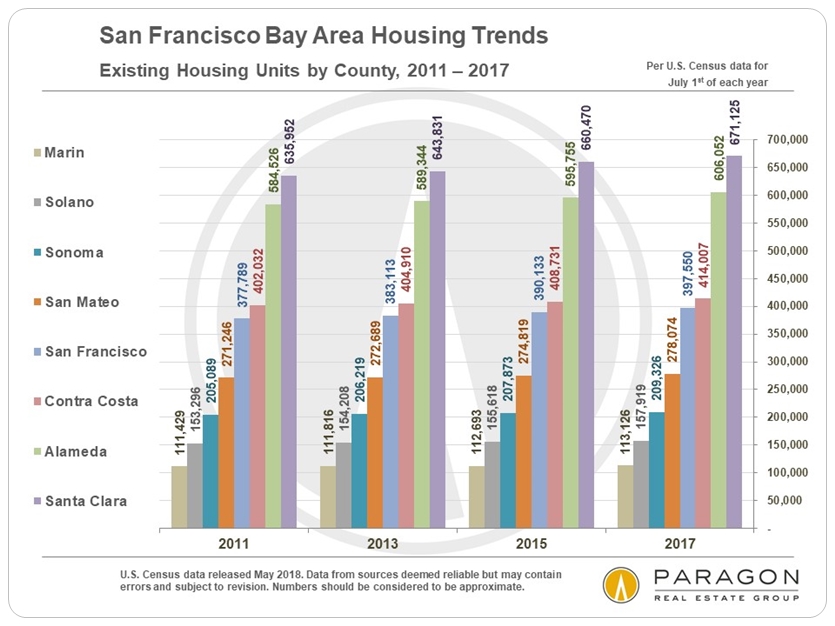

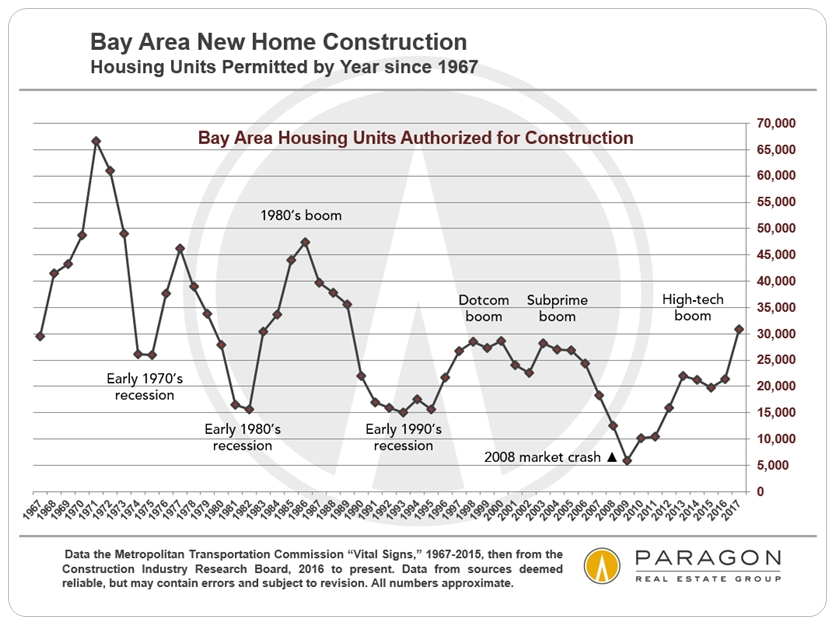

Bay Area Population & Housing Statistics

Our report on local demographics is here: San Francisco & Bay Area Demographics. We guarantee you will learn surprising and interesting things you never knew before.

Bay Area Housing Statistics

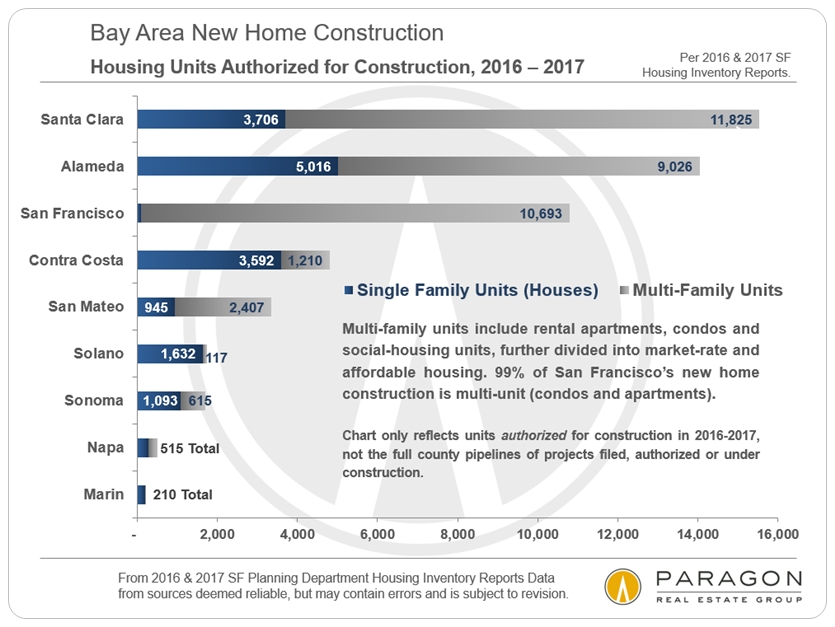

In recent years, some counties have embraced growth in housing supply, and others have resisted it. For better or worse, no county has resisted growth more than Marin. Any way you slice it, housing supply has not come close to keeping pace with the surge in population, a major factor in our real estate markets.

According to a recent report by Turner & Townsend, San Francisco has the second highest construction costs in the world, behind only New York, and these costs continue to accelerate due to a number of factors: land and labor costs; the long planning, approval & permitting process; political opposition to growth; and affordable housing requirements.

————————————————————

Income, Poverty & Housing Affordability

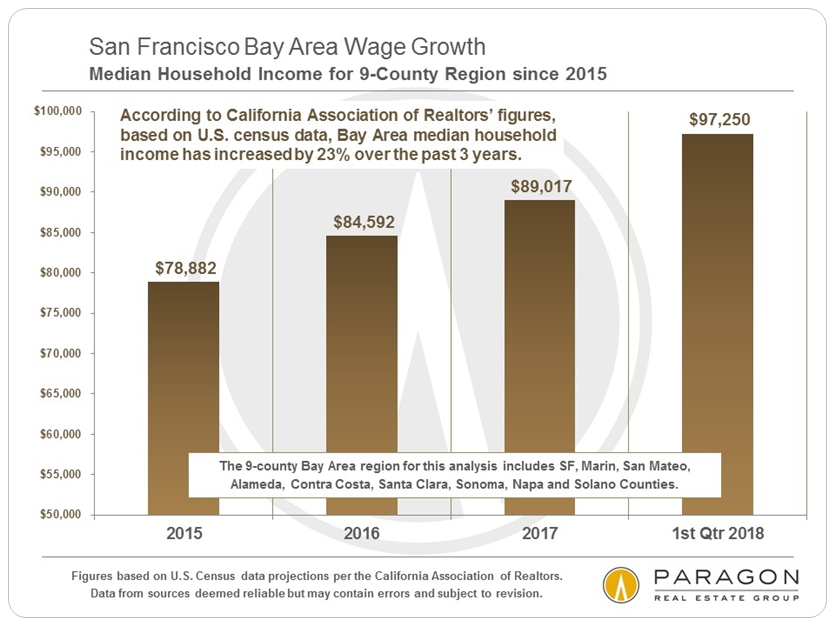

According to the above calculations by the CA Association of Realtors, Bay Area median household income has increased by 23% since 2015, as compared to a 7% national increase (as calculated by Seeking Alpha). Among other factors, it has been reported that people moving into the Bay Area earn considerably more than those moving out.

The Bay Area high-tech boom has been one of the greatest new-wealth-creation machines in history, but many residents have not shared in its benefits, or, indeed, been negatively affected by its impact on housing costs. The Bay Area ranks third for its number of billionaires (after NYC and Hong Kong, according to Wealth-X), but, on the other hand, over a million local residents live in poverty (according to the Public Policy Institute of California). We have one of the great luxury home markets in the country, and one of the worst problems with homelessness.

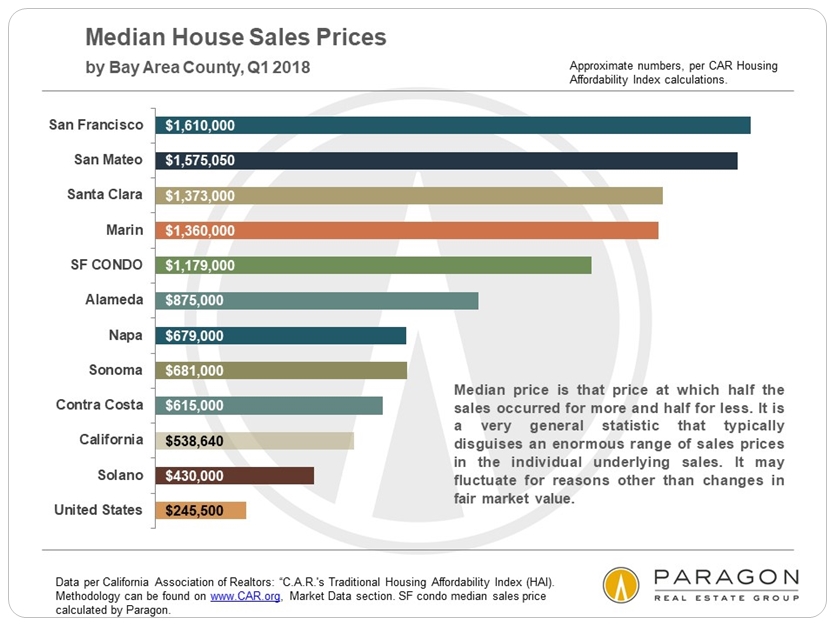

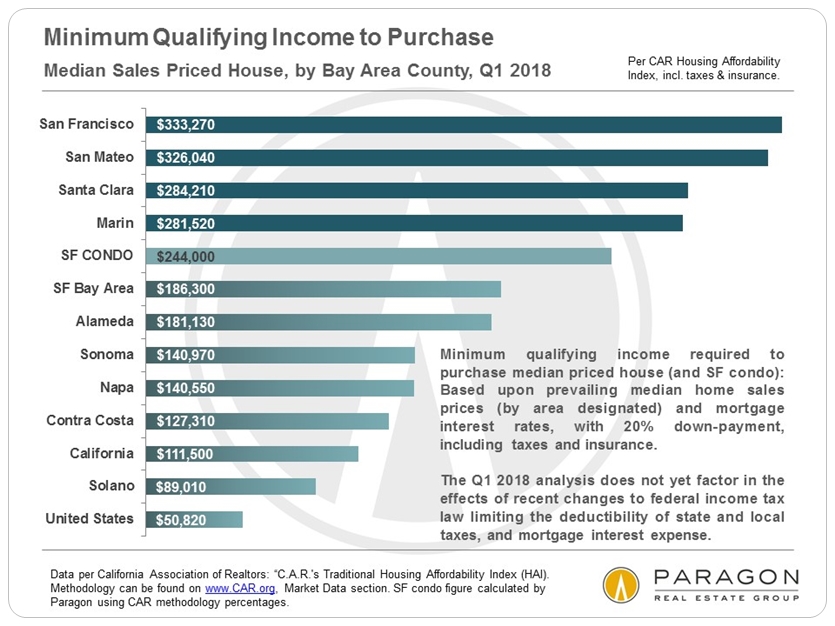

Q1 2018 Housing Affordability Statistics

per the California Association of Realtors (CAR)

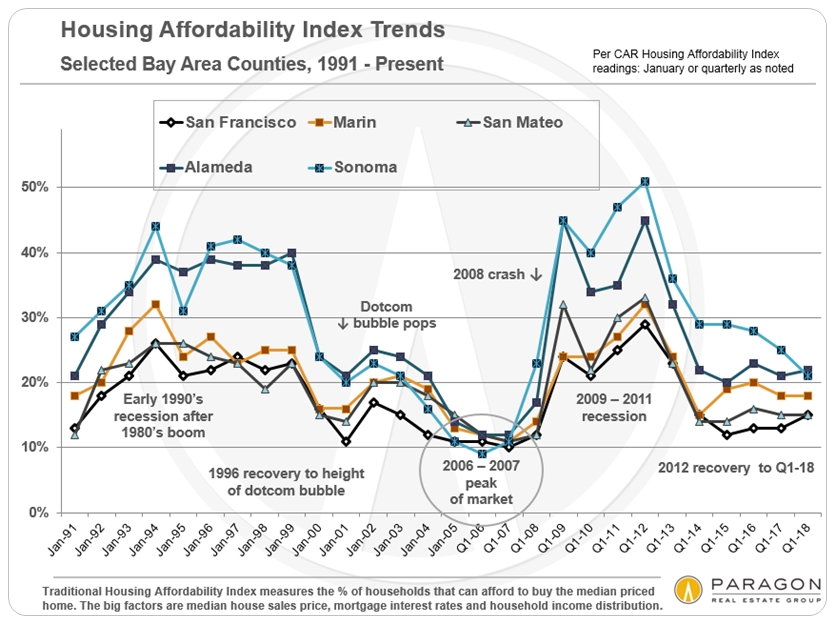

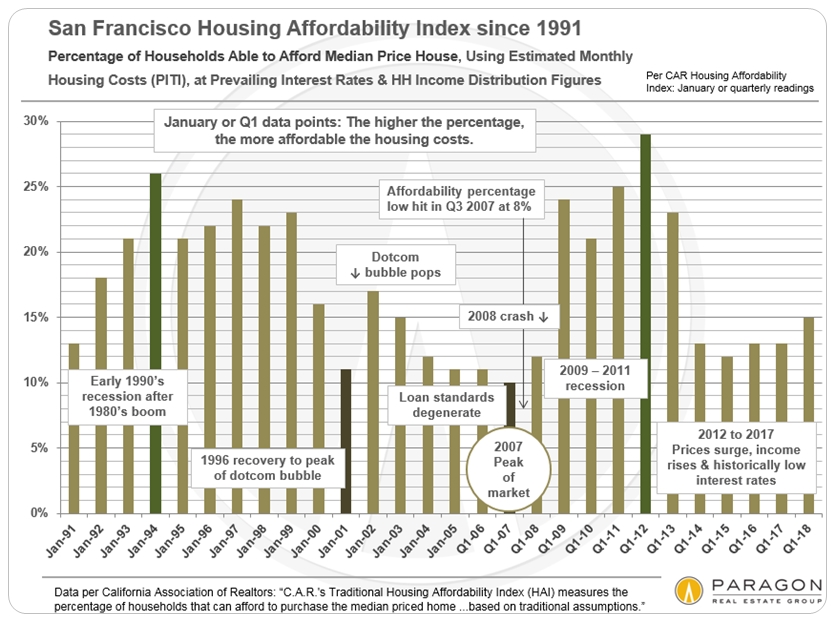

According to CAR, despite very significant increases in median home prices and interest rates, affordability rates ticked up a little year-over-year in most Bay Area counties due to increases in household incomes. This surprises us, but we have not been able to review all the underlying data employed in the CAR Index. CAR has not yet been able to incorporate the recent federal tax law changes into their calculations, which would presumably lower affordability rates due to new limits on the deductibility of state and local taxes (such as property taxes) and mortgage interest costs. Depending on specific financial circumstances, our, admittedly unqualified, back-of-the-envelope estimate is that this will probably mean the loss of tens of thousands of dollars in federal income tax deductions for someone, say, owning a San Francisco house at the current median sales price. (Get more qualified counsel from your accountant.)

According to National Association of Realtors calculations, the San Jose and San Francisco metro areas are the least affordable in the country, just a bit below Honolulu.

————————————————————

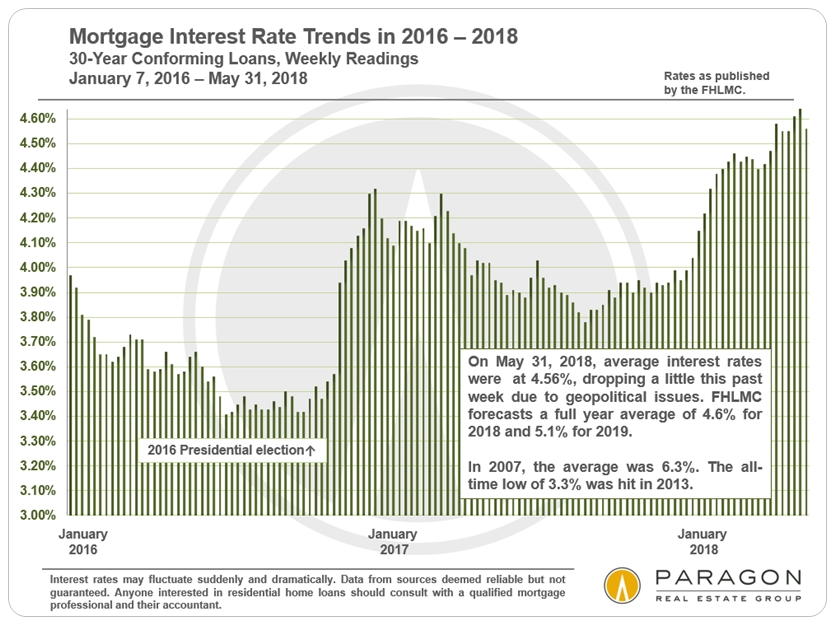

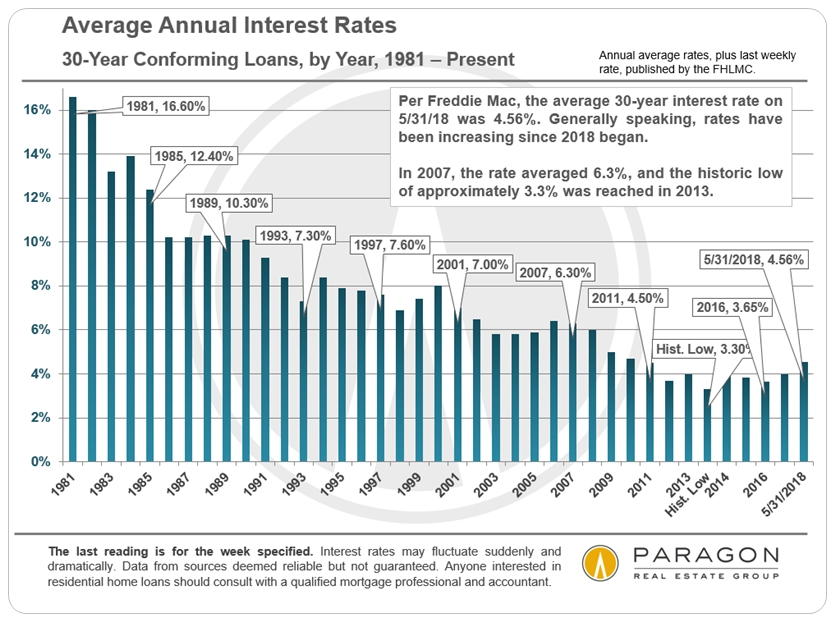

Mortgage Interest Rate Trends

Interest rates play a large role in ongoing housing costs (for those who do not pay all cash). They have risen appreciably in 2018, but so far that only seems to be motivating buyers to act more quickly before rates go higher. Still, at some point, if rates continue to rise, presumably there would be some negative impact on the market. Though considerably above the historic lows of recent years, rates are still very low by long-term standards.

————————————————————

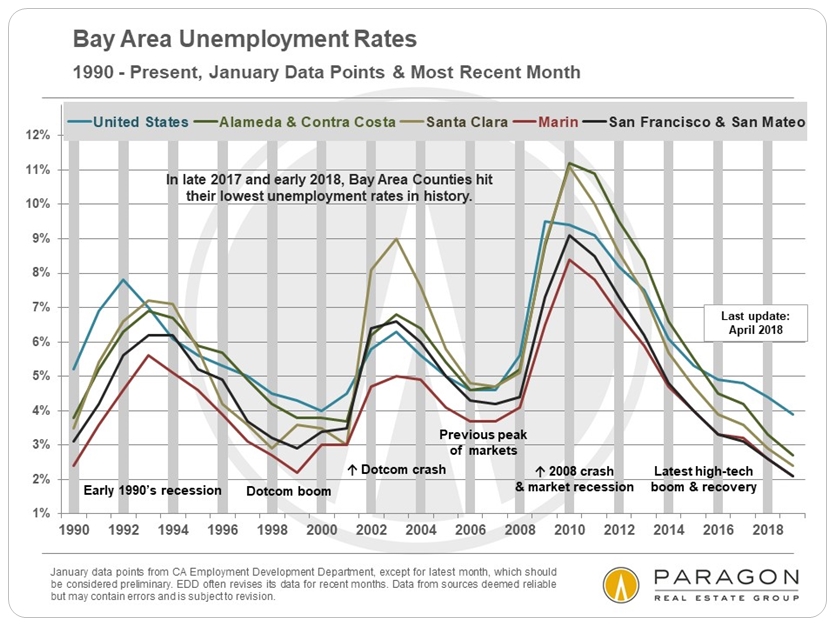

Bay Area Employment Trends

One of the foundation stones of the current Bay Area economy and housing market has been the spectacular increase in employment over the last 7 years, often in extremely compensated jobs: It recently came out that the median salary at Facebook was $240,000. (On the other hand, Mark Zuckerberg made a salary of just one dollar in 2017: Hopefully, he has other sources of income.)

As with all economic trends, employment numbers can also decline suddenly and precipitately, as occurred after the dotcom bubble burst. Note: We are not making comparisons between the two high-tech booms.

Additional reading for those interested:

Report: Positive & Negative Factors in Bay Area Markets

Will the Last Person Leaving Please Turn Out the Lights

30+ Years of Bay Area Real Estate Cycles

All our reports and articles can be found here: Market Analysis & Trends

————————————————————————–

These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in the Bay Area, each with its own unique dynamics. Median prices can be and often are affected by other factors besides changes in fair market value, and longer term trends are much more meaningful than short-term. It is impossible to know how median prices or general appreciation rates apply to any particular home without a specific comparative market analysis. All numbers in this report are to be considered approximate.

© 2018 Paragon Real Estate Group